The need for adaptation finance currently and in the future, Bangladesh will be dictated by the economic losses and damages (L&D) inflicted by the recurring and devastating climatic disasters that visit Bangladesh each year. As of yet there are no authoritative, national-level L&D assessments in Bangladesh, but international development agencies like the Asian Development Bank predict that 2% to 9% of our GDP might be lost a year by 2050 due to climate change impacts.

The government of Bangladesh already invests about Tk25,000 crore (close to $3 billion) a year for addressing climate change impacts. Against this, the international finance support for climate change adaptation (CCA) is minimal — contributing about 20% of the needed investments. The Nationally Determined Contribution (NDC) estimated overall adaptation measures will cost $42bn (2015-2030) in the major 10 sectors of our economy. Most finance will go towards “comprehensive disaster management” followed by flood and riverbank erosion protection.

A study by the International Institute for Environment and Development (IIED) based in London shows that the rural households in Bangladesh already invest over $2bn per year for protecting themselves against the recurring climate disasters, at the expense of other household needs. Nevertheless, it is difficult to have a proximate quantified value of Bangladesh’s adaptation needs for the widely differing cost estimates from climate impacts. There are seven main sources for climate change-related financing of which the domestic sources include: (1) Revenue budget, (2) Annual Development Programme (ADP), (3) Bangladesh Climate Change Trust Fund, and the international sources include (4) multilateral climate funds including the Green Climate Fund, (5) bilateral aid and multilateral development bank (MDB) funds, and (6) INGO funds. But these sources of public financing will suffice at all, compared to the growing need for adaptation.

So, our piece shares some ideas about a few potential sources of private financing and public-private partnerships as sources of finance for adaptation in Bangladesh.

Private sector finance such as insurance and green bonds

In Bangladesh, there is sizable access of people and communities to savings, bank loans, microfinance, and mobile financial services. Here the need for insurance comes as a risk management and risk transfer tool. Local communities in Bangladesh can be capacitated to deal with insurance schemes, especially by the smallholder farmers. However, though small-scale farmer insurance schemes started back in the 1980s in Bangladesh and since then many pilots have been undertaken by many national and international organizations, they remained at pilot scales. Why are they not scaling? This is something we need to seriously think about despite the fact that the government has some institutional framework in place.

The green bond is a unique initiative of using debt capital markets to fund climate solutions; for instance Sajida Foundation aims to use the funds raised through the Green Zero-Coupon Bond to increase the outreach of its microfinance program as well as ensure environmental development like agriculture, sanitation, and solar projects. But our development finance still mostly depends on bank financing. The bond market remains underdeveloped. For this, viable PPP models need to be devised where the government can provide incentives through tax exemptions and low-interest loans from public banks and the private sector must come forward with a sense of social and environmental responsibility to the society.

So some kind of blended finance through PPP denotes the use of concessional and non-grant financing sources. In Bangladesh, where public finance remains constrained, blended finance could be an option to meet the adaptation needs. In this case, the tax-GDP ratio could be raised through better mobilization of tax to enhance public resources for incentivizing private sources.

Payments for ecosystem services (PES) works through paying landholders or farmers for actions that preserve the services to public and environmental health provided by ecosystems on their property, including services that contribute to both climate change adaptation and mitigation. There are ample cases of mitigation-focused PES schemes and more recently evidence is emerging of the use of PES for adaptation which is of pilot nature and location-specific in many regions across the world.

We must learn about this.

Locally-led adaptations

Debt for adaptation swap can help uptake more locally-led adaptations (LLA) funding by including the debtor countries, local governments, and actors. Since LLA focuses on local leadership, communities can complement pool funding for adaptation. The new Climate Bridge Fund established under Brac with support from Germany through KfW works directly to address injustices faced by climate refugees in urban slums in Khulna, Rajshahi, Barisal, Sirajganj, and Satkhira.

The projects improve the provision of basic services including water, sanitation and hygiene, housing facilities and waste management, livelihood development, and access to financial services. This fund can be harnessed to support more adaptation projects, and mobilize local leaders as agents of change.

The United Nations Capital Development Fund’s (UNCDF) Local Climate Adaptive Living Facility (LoCAL) has been piloted in Bangladesh and the upshot was instrumental, especially for vulnerable women and girls in remote villages. The grant resonated sustainability in terms of providing lifelong livelihood options to adapt to climate change.

Green microcredit

The microfinance institutions (MFIs) can put terms and conditions for a housing loan, and advise their clients to use a design that is sustainable. For instance, Grameen Bank borrowers are required to follow a certain building design that integrates concrete pillars and corrugated sheets for better adapting to climate change. Similarly, the borrowers could also be motivated to plant trees around their houses to provide protection from destructive winds and receding floodwaters.

International sources

In the coming years, the Green Climate Fund (GCF) and the Adaptation Fund (AF) are going to be the sizable vehicles of CF. This will require capacity building for negotiations and bargaining. It is therefore vital to utilize the Readiness Support program of GCF. It is believed that much more money can be mobilized annually for adaptation. This will require two things: Capacity building to write fundable projects; better and more transparent fiduciary management systems.

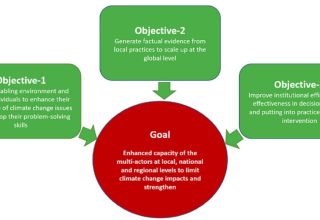

However, the guiding principles must include a whole-of-society approach including all the stakeholders, namely the government at national and local levels, private sector, NGOs/civil society, INGOs, women groups, the youth, the media, and development partners must be in regular dialogue and consultation to guide the strategy. Additionally, prioritization of funding with a programmatic approach, with setting of criteria, such as the vulnerability of people versus growth of specific economic sectors will be crucial for financing future adaptation in Bangladesh.

This people-centric lens in all investments, including the now preferred areas of infrastructure building by our sectoral leaders, must be the guiding criteria if we want to realize the vision of the Father of the Nation Bangabandhu Sheikh Mujib.

Originally this article was published on April 21, 2022 at Dhaka Tribune.

Dr. Mizan R Khan is the Deputy Director of International Centre for Climate Change & Development (ICCCAD), and Programme Director of LDC Universities’ Consortium on Climate Change (LUCCC).He can be reached at mizan.khan@icccad.org.

Afsara Binte Mirza is a Junior Research Officer at ICCCAD.